With all the hubbub these days about “the mortgage renewal cliff”, I’ll chime in with an easy to understand myths versus facts on mortgage renewal, and your steps on approaching your renewal.

First off, don’t stress. Instead, just read this. Once you’re done, you’ll be much calmer, and ready to figure out your next move.

Honestly, this isn’t a “just call me” sales pitch. Sure, there is some of that (mostly in the middle). I’m good at doing people’s mortgages. I have to keep getting the word out.

There is useful information here that’ll help you understand your renewal process. The step by step guide is near the end, with a form to fill in your mortgage info if you’d like to talk to me.

Like I always say to all of my clients. Gather all the data first. Then decide. (if you want to call me). 2508587160 if you do.

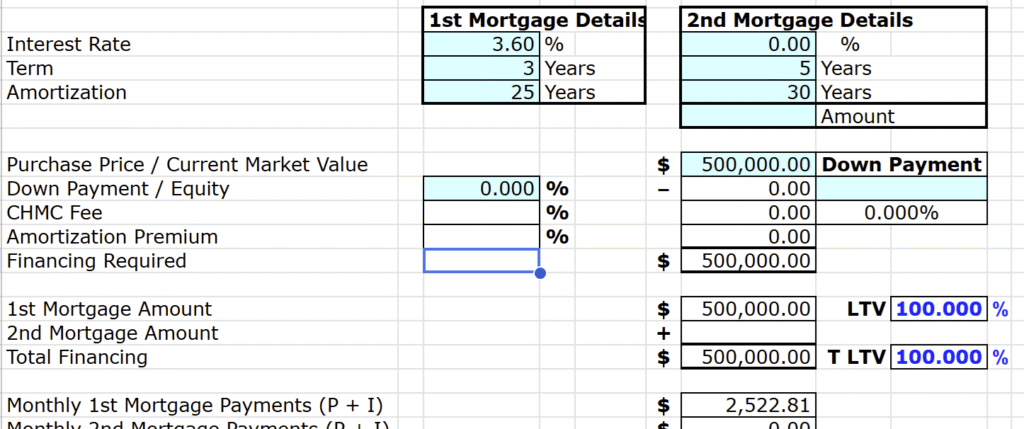

Your mortgage is amortized over a long period of time. The rate increase is spread over the next 25 or 20 years of your mortgage. Likely, you’ll only experience an increased payment of a couple hundred dollars.

I can help you with the math very quickly and easily. I have my handy mortgage calculator, here’s an example:

Yes, rates are higher than they were 5 years ago. But the increase is not as dramatic as the headlines make it sound.

If you’re just staying with your lender and not increasing your mortgage amount, you don’t have to requalify. Full stop.

You’ll just need to negotiate the rate with your lender and eventually sign the renewal with them, on the agreed upon rate.

If you need to borrow more money from them, or extend the amortization back to 25 or 30 years, then you’ll have to start a new application, with them, or with us. (or with both).

Requalifying and negotiating is where I step in. I help you figure out all your options, whether with your existing lender or a new lender.

Foreshadowing: As a mortgage broker, I help you figure out if your lender’s offer is good, or garbage.

There’s more to just looking up a rate online and quoting what you see to your lender. Each mortgage is different. It really matters whether your mortgage is insured or uninsured.

When you call me, I help you figure that out first. Then we talk about rates.

I’ll tell you what other lenders are offering for rates. I can even help you negotiate your mortgage rate too (I tell you what to say to them).

And if the end result is that you stay with your lender, great! I’ll ask you for some referrals and a Google review. I help so many people without actually getting paid. It’s part of my job.

They’ll start contacting you about 6 months before your renewal date, and they’ll may make you nervous about rates going up. Guaranteed. More below about renewing early (in myths).

It’s always in the bank’s best interest to lock down their clients on long fixed terms, and to do it early before Mr. client realizes it’s too late. Don’t take their first offer!

On rates: At this point it looks like rates are holding steady or maybe even going down. Which tells me its better to wait until closer to your renewal date to lock in a fixed rate (with your lender or with another lender).

When your lender tells you that you can renew 6 months early, that means you can shop around 6 months early too, right?? Nope!

When your lender tells you that you can renew 6 months early, that only means that you can renew with THEM 6 months early.

At the 6 month mark, you can’t change the mortgage to a different lender unless you pay the 3 month interest penalty. With 6 months left to go, no one wants to pay a 3 month interest penalty.

So if I’m dealing with your renewal, we’ll payout your lender on the day of renewal, and not earlier, unless you really need to. We want to avoid penalties.

Has lot’s changed in 5 years? Job change? Went from being employed to self employed? Lower income? Higher income? What’s changed?

Even if you think you’re stuck, you may as well be sure about it. Repeat: gather the data, then decide.

How do you know if you can or can’t take money out to consolidate your debt? How do you know you can or can’t take money out to buy a rental property? Are you the mortgage broker?

Fact: Until you talk to me, you don’t actually know what your options are. Stop guessing.

You’re still missing the main piece. What are you going to do? Before you jump straight to the renewal guide below, let me interject with one more crucial point.

Your mortgage renewal is an opportunity for financial planning. An opportunity to really figure out what your options are, not just for your rate, but for taking money out of your equity and putting it to good use.

The planning opportunity is the main reason you should call me.

The renewal step by step guide is still below, just keep scrolling past the “why you should call me” stuff.

Strategy. Asking the right questions. Planning for the future. Kids. University. Cars. RRSPs. I ask you all the questions. Then, we figure out if you need to access money from the equity in your home.

Opportunity: Say you’re at your highest income earning bracket now, but you know that’ll go down in retirement. Plan: Take money out to invest in your RRSPs. Outcome: You lower your tax by a huge amount now, and take the money out in stages, when you need it, at a lower tax bracket.

The above is just one of many opportunities we will look at together during our call.

I look at all aspects of your financial situation. I propose different solutions on how to make it better. I’ve helped many people buy rental properties by refinancing, and it’s really not that hard. But it does take……. strategy.

I make sure that your finances makes sense with your debt. Because I’m the debt manager. (link takes you to my disclaimer about “titles”).

And imagine, you figure all of this out in the span of 15 to 30 minutes, with me. The planner.

If you decide to move forward with me after our planning conversation (whether just for interest rate negotiation or an equity take out), you can trust you’re in good hands.

My background, for those new here: I started bank tellering in 1999 when I went to business school (majored in finance and risk management). After my BComm, I was an HSBC Account Manager and mortgage underwriter from 2004 to 2009. Then, I was a sub-mortgage broker from 2009 to 2014. Finally, I started Olympic Mortgage in June 2014.

Since 2009, I’ve brokered around 1700 purchases, 1000s of refinances, and some renewals, when it made sense for the client.

I’ve been around the block. I’m happy to have a 100% track record. 0 deposits lost on purchases. Even happier that 99% of my clients have all ended up in AAA lending (that’s banks, credit unions, and monolines).

This is one of the most important decisions of your financial life. Don’t leave it up to chance. Call the guy (me) that’s pretty darn good at getting his clients exactly. what. they. want. Every. Time.

Read our reviews: Most happy clients in Victoria, according to the google reviews.

Yeah, I can be blunt at times. But my clients appreciate a little truth pill and the direct approach. Believe me, I want what’s best for you. Because when you’re happy, I’m happy too.

I have an amazing team that helps me get everything done.

We’re dialed in. We make sure there aren’t screwups along the way. We’re thorough. We’re prepared. We handle your file like pros. Clear strategy and communication. You get the team on your mortgage. You not only have one number to call, but two. And our people are right here in Metchosin, Colwood, Langford, Oak Bay, Esquimalt – we’re actually here in Victoria.

You get me on strategy, and you get the expert team on the admin. We’re a tight ship, so to say. No stragglers here.

You may want to use your equity to:

If you’re any of the above you really should call me (yes), or another mortgage professional (ugh), or your bank (I guess so). Heck, you can even call both myself and the bank, just so you have that 2nd opinion.

I’ll lay out all your options, and let you know if I think it’s worth it to ask your existing lender. No obligations here, I’m happy to give you a 2nd opinion.

I help tons of people with that 15 minute conversation. And unless I’m adding value by qualifying you for more money, or negotiating a much better rate with a new lender, I step aside.

If you don’t need to make any changes or borrow more, ask the lender for their renewal offer.

Simple. Ask your lender for their absolute best rate on the term that you want.

Not sure if you want fixed or variable? Well, you can call me and we can discuss that too.

I can tell you if I think we can get something much better, or I’ll tell you to take the offer.

Fill out some of the form or all of it, it doesn’t really matter. We will go over everything. Just tell us who you are and the best way for us to get a hold of you.

The “mortgage renewal cliff” makes for good headlines. But for most homeowners, this is simply a decision point — not a crisis.

Don’t panic.

Understand your options.

Make a plan.

And yes — call someone (preferably me). I plan it all out with you and make it all make sense.

I’ll give you straight advice. Whether that means moving your mortgage or staying exactly where you are.

Signing off for now,

David Steinberg, Mortgage and Debt Strategist

Lead Broker, Owner, Olympic Mortgage –

Call me, text me, or email me: 250-858-7160, or david@olympicmortgages.ca