Lately, we’ve had plenty of people calling in and asking about interest rates. The main question is obviously, are rates going up, or down?

In a recent poll conducted in my last email, out of 223 respondents, we had 35% of people predicting rates will come down, 30% say that rates will hold steady, 10% say that rates will increase, and 25% say that it’s too hard to predict. Some very split opinions, to say the least.

So now, I’ll explain my point of view, but also more importantly, how it relates to your mortgage strategy.

A quick disclosure – I have to say that I’m not an economist or analyst. I don’t get overly technical in predictions, and some might think my analysis is oversimplified. They’re probably right. I’m not getting too technical because I don’t think it’s necessary. You don’t really need to understand the inner workings of economic theory. What you need to understand is the macro view, or the bigger picture, and how that bigger picture shapes your mortgage strategy.

To start – and this will be a bit of a let down, but no one can really say for certain whats going to happen with interest rates. Why? Because we’re still in a “wait and see” mode. How will our real estate market and economy react to the barrage of interest rate increases so far? Is inflation coming down in a meaningful manner yet, and will it hold at it’s current? Will our economy go into recession, (and what actually is a recession)? Essentially, we need more economic data. We need more “stuff to happen”, before we can say definitively which way things are headed.

Before I get into the predictions themselves, let’s start with what we know so far.

1. The BoC (Bank of Canada) has been aggressively increasing rates since March 2022 in order to quell high inflation. The overnight rate went from a low of 0.25%, all the way to 5.00%, and our bank prime rate went from 2.45% to a whopping 7.20%. 5 year fixed rates jumped from historic lows of 1.75% all the way up to 6.00% over the last 2 years. We haven’t seen rates this high since the early 2000’s.

2. As a result, inflation has significantly dropped from highs of 8% annually, to just around 3% at it’s current rate. The Band of Canada’s target for inflation is 2%. So, we’re close, but not quite there yet. Some economists do say that this last 1% decrease is the toughest to obtain (some foreshadowing here).

3. There is evidence that our hot economy is starting to flat-line. Some impactful news came out late Thursday indicating that our GDP (gross domestic product), actually went into negative territory for the 2nd quarter of 2023 (even though most economists were predicting a positive GDP). From this point, if we have another quarter of negative GDP growth, we will technically be in recession. A recession is defined as two consecutive quarters of negative growth. Banks are reporting lower profits due to having to increase their bad loan provisions, and less consumer borrowing overall. Unemployment figures are also going up, however slightly. Companies and families alike are being affected by the higher rates.

All in all, there is evidence that the aggressive rate hikes are slowing down our hot economy. Savings rates have increased as a result, with bond funds and savings accounts returning high yields to investors (and forcing our fixed rates to peak).

Given mounting evidence that the economy is flat-lining, we can probably rule out any more huge rate increases. It seems like we’re at or near the top or rates, considering the rate has more than quadrupled from it’s low.

Even though our economy is showing signs of slowing, the recent declines are not big enough and cannot be relied upon to assume we are out of the red yet. Inflation is still at 3%, too. The economy could take an upswing, which could cause rates to rise slightly, or at minimum, maintain their current levels for some time.

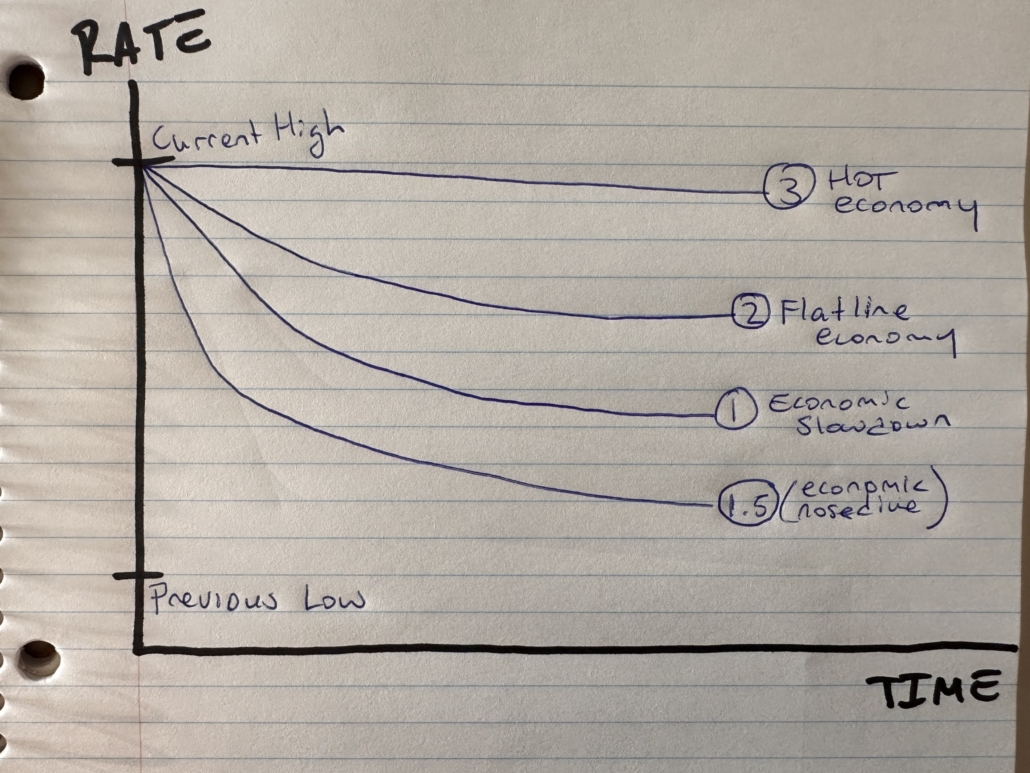

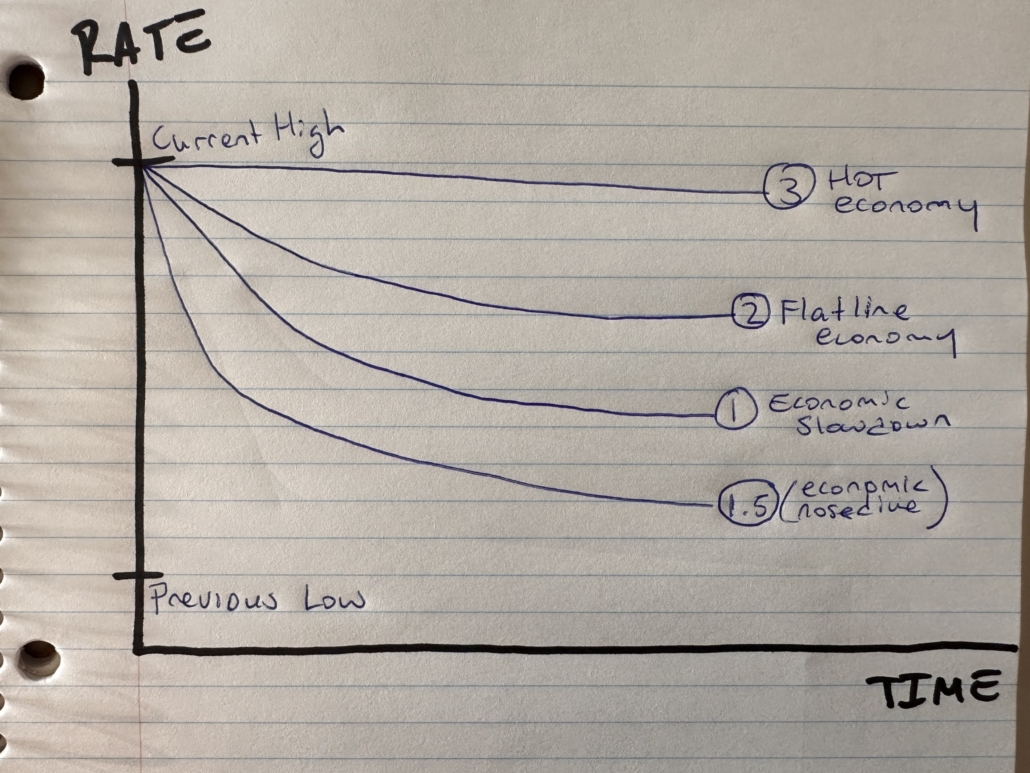

Three Potential Outcomes For Rates

1. If our economy continues it’s slow decline, we can expect interest rates to gradually drop. The BoC will not drop rates too fast in order to avoid a resurgence in inflation, and still, the BoC is committed to seeing inflation at their 2% target.

If our economy takes a sudden nosedive due to some world event, such as a resurgence in Covid, we could see interest rates come down at a faster pace. We probably wont see our previous lows, as the BoC will remain vigilant in keeping inflation in check. They will do anything to avoid a repeat of inflation rates soaring to 8%.

2. If the economy remains steady, we can expect interest rates to hold, or very gradually decrease from our current highs. The currently high rates are restrictive enough to hold off surging inflation.

3. If our economy heats up again, and inflation increases from the current mark of 3%, we might see interest rates increase slightly, or as is in the previous case, rates will stay as is, for longer. My reasoning here is because our current rates are at 23 year highs and are quite restrictive on lending.

In all three scenarios, I’m referring to the general trend on interest rates. That being, the line on which rates follow is more or less straight and heading in one direction. Check out the three (well 3.5) general scenarios here.

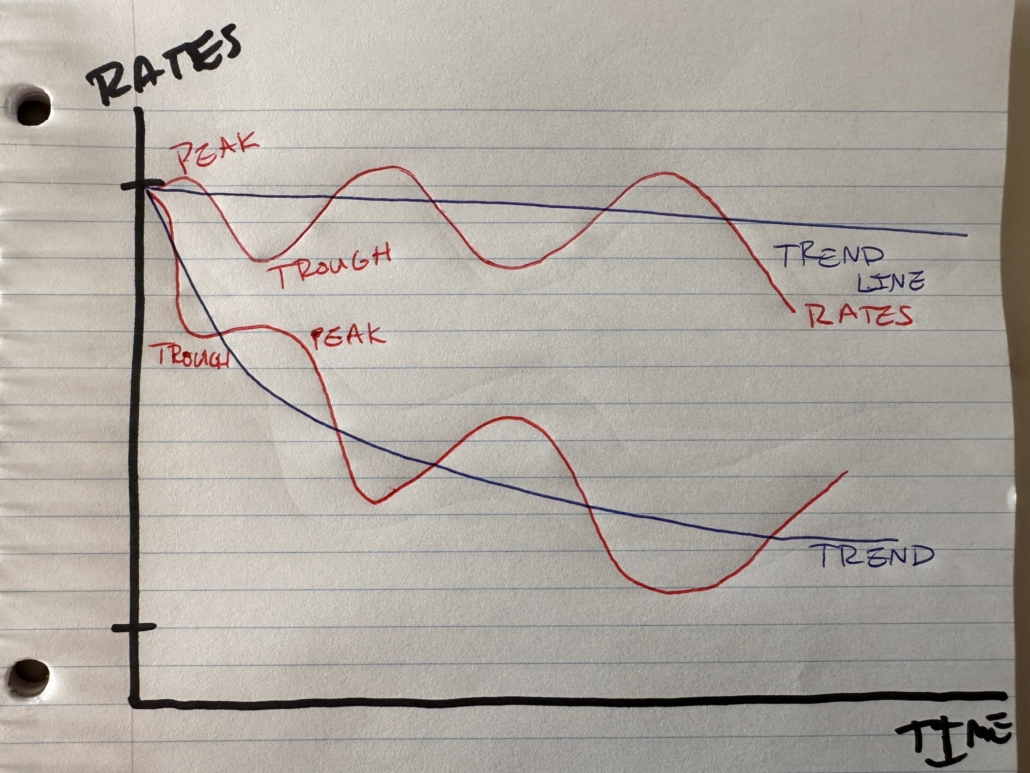

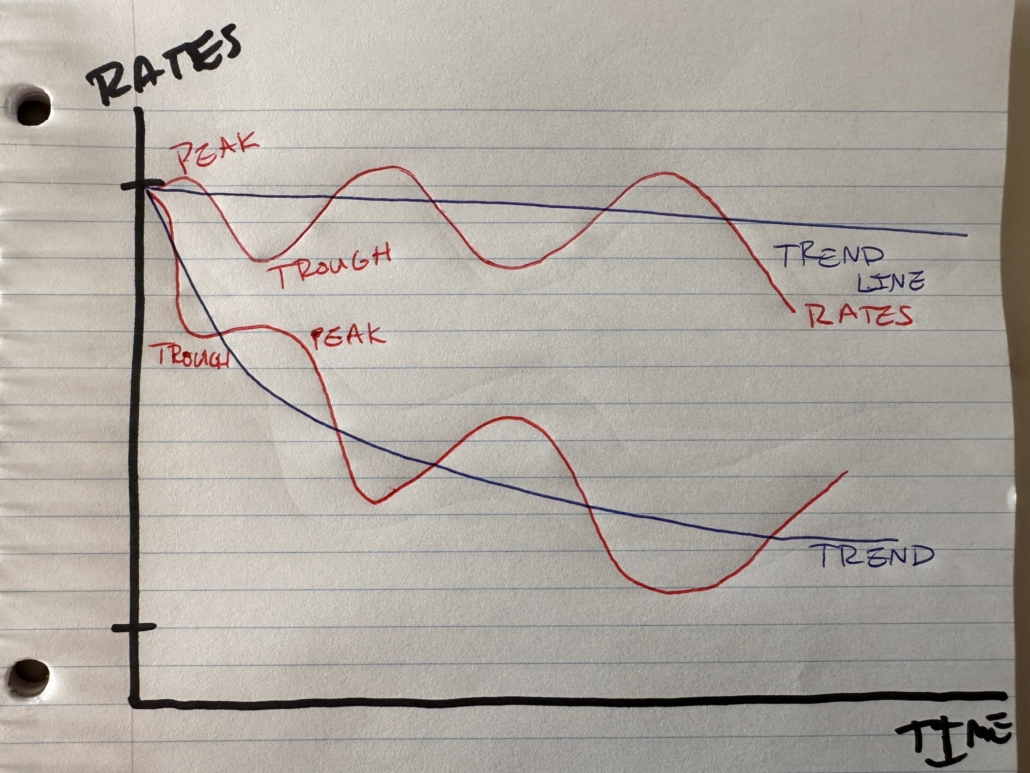

However, fixed rates don’t really act in the same manner. Rather, they have fluctuations up and down while following along the general trending line. It’s sort of like a rollercoaster, with peaks and troughs.

If we apply this rollercoaster concept to our scenarios, the graph might look something like this.

Currently, whether the general trend is a flat-line or going down, I think we’re at a peak of fixed rates. Given how high rates have already come up, there is more of a statistical chance that rates will come down, even if for a short time.

So how does this translate to your mortgage strategy? Stay short term, if possible.

If a short term mortgage is available at a decent rate, take it. Locking into a 5 year fixed rate at 5.5% or 6% could be a mistake, if in 6 months to 1 years time, rates return to the 3.5% to 4.0% mark. This isn’t entirely unreasonable, as our lows were at 1.5%. Getting back down to 3.5% or 4% isn’t a stretch whatsoever.

At Olympic Mortgage, we’re offering a 6 month mortgage which is perfect for this rate environment. You’ll save 1% to 2%, compared to other interest rate offerings, and in another 6 months, we should have a much better indication as to what rates are doing. Rates will most likely be lower than they are now. The 6 month fixed rate gives you time to wait out the high peak that we’re experiencing. Then, in 6 months time, you can take a variable rate if you want to keep waiting for even lower rates, or at that point in time, lock into a different fixed rate term.

A few important notes – the 6 month special is for qualifying deals only, and your rate depends on your mortgage size and loan to value. Rates vary from 4.25%, up to 5.00%. Not everyone’s rate is the same. Also, as this mortgage product is available for insured or insurable deals only, and this may not even be an option for some people.

For more clarity on if you qualify for this rate or if it’s right for you, and more details on this rate special, contact our office and we would be happy to help you work out your options. This rate is available for a limited time only, and rates are subject to change without notice at anytime.

Email us for more information.

Signing off for now,

David Steinberg, AMP, BComm

Owner, Lead Broker

Olympic Mortgage