BoC Rate Announcement. Is It Really Breaking News?

Can we just chill out, please? Does every rate announcement have to come with the “breaking news” prelude? I see the same thing happening literally 10 times a year (imagine that). A flood of emails and social posts at 10am on Wednesday morning from anyone and everyone about the BoC announcement, because it’s a soundbite.

Let’s cut through the noise.

We have to realize, the BoC rate announcements are not “breaking news”, and will not be “breaking news” until they actually lower the overnight rate by a significant amount (significant amount means more than .25% at a time). With bank prime sitting at 7.20%, going to 6.95% isn’t going to be a big enough drop to make any significant difference on a mortgage payment.

There probably won’t be any instant gratification, that many might be looking for. There is some relief on the horizon though, which I’ll talk about a bit later.

Keeping perspective on the numbers – the BoC drops by .25% at a time, it will take 4 BoC announcements to get to 6.20% bank prime rate, and that’s still 4% higher than our previous lows from the COVID era. The BoC is going to keep rates at existing levels until our economy has truly contracted. Even if the BoC starts to drop the rates, there’s no guarantee they’ll do it at a steady pace. The rate doesn’t come down in a straight line. On the flipside though, the BoC could drop by more than .25% at a time, which would offer greater relief, faster. It’s a wait and see call.

Advice to those in a variable rate mortgage.

My advice to those in a variable rate mortgage: keep going for now, and wait for fixed rates to drop low enough to a comfortable lock in point. Let’s say around 3.5% to 4%. Trust me, it will happen, eventually. Fixed rates have peaked, for this cycle, anyways. Fixed rates will eventually drop, as they have already started to do (peak was in the summer of 2023). If you wait long enough, you’ll ultimately benefit by locking in at a much lower rate. (hint, wait until November 2024 when the US of A has their election).

Remember, things take a little longer to happen. Things don’t happen so quickly. All the constant bombardment from media about interest rates doesn’t help. There’s too much media now, with social media bombarding everyone with constant news stories. It keeps this issue top of mind. Yesterday morning even, I facetimed my mom, and before she even says hello she launches into how the news was terrible, rates didn’t come down. I had a bit of a laugh and told her that hinging on each rate announcement isn’t something I do. My clients have bigger perspective. We kept going to talk about the kids. We have this sort of call at every rate announcement anyways, LOL.

Another point – it’s not going to previous lows. The BoC is going to be weary to not drop too fast or too much, because, well, inflation.

Remember how fast we all got into this mess? This inflationary bubble we’re in? It was low rates, mixed in with a disaster of sorts (COVID), at which point the BoC made the bad call of lowering rates to near 0% (.25% at it’s low), thereby opening the floodgates of credit, so to say, causing the flood of money into our economy.

Too much money flooded our economy. Too many dollars vying for more dollars, in the form of goods and services.

On a side note, the much hated carbon tax hit us this last week. We’re all paying significantly more on gas. Even those with electric vehicles don’t get away without paying more, as we all pay more for the transportation costs of the goods we consume.

There is relief on the horizon.

Back to the interest rates. I’m not saying that rates are going to stay high forever. The BoC will use the interest rates to get the economy going just enough to avoid a recession. We’re experiencing our soft landing now. The higher rates will and is ultimately cause our economy to contract. Less investment and less business investment will mean less money entering the market. Prices will contract.

As soon as BoC sees evidence of the contraction, they will start to decrease the rate.

By how much will the rate come down? If there’s a major contraction in the economy, we could see rates dropping faster, as soon as it starts. If we keep experiencing a “soft landing”, it will take more time for rates to drop.

Keep the bigger perspective, please.

No, really. Sometimes I ask my clients to think about the bigger picture. For example, let’s look back 5 years. Do you remember if the rates dropped in November of 2016, or February of 2017? Do you think it made a large difference or impact in your life? Maybe at the time, yes, but now, it’s just a distant memory.

When it comes down to it, we don’t remember the small details. We remember the big ones though. And by big details, I mean, purchasing a house in 2009 for $400,000, or even purchasing a house for $800,000 in 2020. Both of those buyers would have experienced a huge jump in equity and wealth, and that is the kind of detail that someone will remember.

There’s a saying I ask my clients to remember when they are griping about how high interest rates are right now. Date the rate, marry the property. The high rates will only be around so long. Property values will keep going up, and as long as your real estate purchase is for the long term, you’re going to do well, even if you start out at a higher rate.

I think that’s about enough for today. You’ve probably heard enough!

Signing Off For Now,

David Steinberg, AMP BComm

Olympic Mortgage

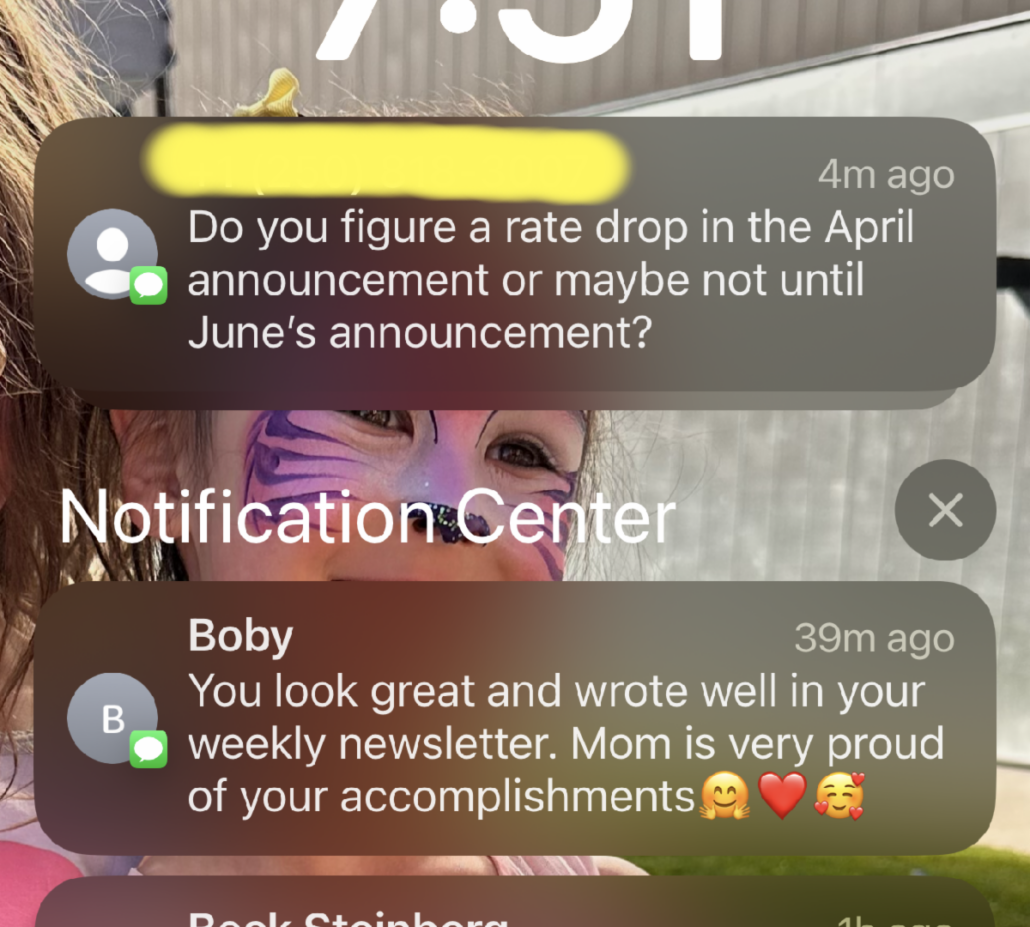

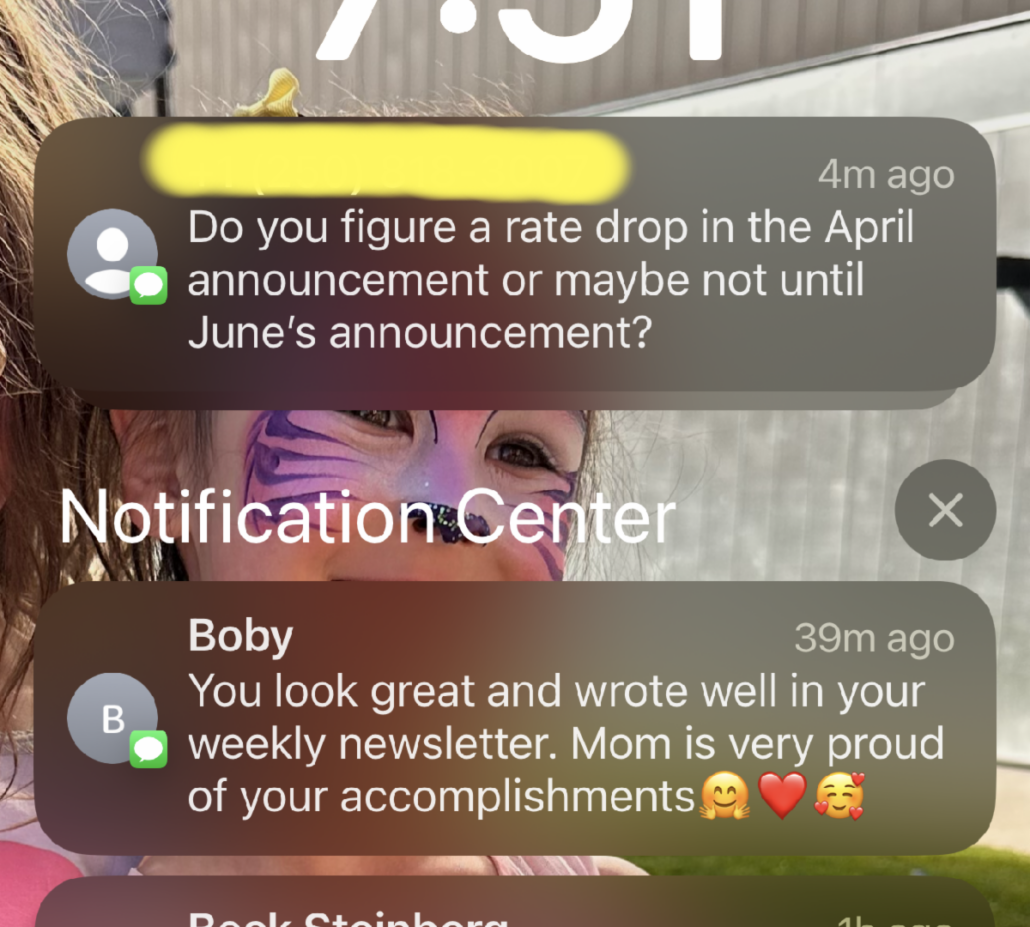

A different sort of review this week, this one is a screenshot of my phone. Thanks mom! Also a very common question I receive often from another colleague.

Interest Rate Update:

Fixed rates again crept up in the past week and a half. While we expect fixed rates to continue their general decline, this doesn’t happen in a straight line. Slight variations in rates are expected.

What should you do? Contact us to get a rate hold in place. If your mortgage is closing in mid-May or later, we will get you the lower rate, if there are any significant rate drops between now and the closing date.

Lots can happen in two months, or nothing may happen. Either way, we have the situation covered.

Here are those suggested rate ranges as of today:

3 year fixed – Between 5.29% and 5.65%

5 year fixed – Between 4.99% and 5.45%

5 year variable – Between 6.14% and 6.80%

INTEREST RATE EXPLANATION:

These days, there are many various types of mortgage transactions which come with different rate offerings. Your rate will depend on various factors and qualifications.

This type of rate environment makes it difficult for us to post any sort of rate sheet. Rates are also changing far too frequently. It’s a moving target on any specific day!

To add, the banks are becoming more aggressive in rate pricing, but only after they evaluate and approve the mortgage. Once the deal is approved at a bank lender, a “negotiation” of sorts can start.

So I’m moving towards trying something different and just posting suggested ranges of rates. Ultimately, I’m going to say: Call us or email us to get your individual rate quote!

Pricing for rental properties is different and will vary from lender to lender. The above rates are for principal residential mortgages only.

The 15 Minute Rate Quote. It won’t hurt!

That’s what I say to anyone thinking about getting a 2nd opinion. If you have a bank or broker that has already promised you a rate, you aren’t yet committed. Who knows, maybe I can come in lower?

It just can’t hurt to try, especially because it only takes 15 minutes.

No obligation, you just get more clarity on your overall financial outlook.

So pick up the phone and get clarity. And if you have friends or family that need a good dose of clarity, pass on my number. 250-858-7160.

I’m IN the Office! Come say hello or let’s book a coffee.

After some time working out of my home office, I’ve decided it’s time to get back into a more central work location, and to make myself more accessible to, well, everyone!

Let’s book a coffee!

Where? I’m at the Uptown Spaces location, right behind Best Buy. Parking is easy, and it’s generally easy to find.

Uptown Spaces – Suite 301-3450 Uptown Blvd.

Book a Coffee With Me Here!

There’s so many things happening in the real estate and mortgage industry. As always, I want to ensure you – my clients, colleagues, and friends, feel welcome to call me up, email me, and now, come and see me in person. Whether we’re talking business, your mortgage, or anything else, I’d love to see you.

I’m back to the office!