Protected: This one’s a doozy.

There is no excerpt because this is a protected post.

Originally Published on November 7th.

Since my last update 2 weeks ago, here is a summary of the important economic data points and events:

Benjamin Reitzes, an economist with Bank of Montreal, called the GDP numbers “one more crystal clear sign that the Bank of Canada should be done hiking,” adding that the weak showing will “cause recession chatter to ramp up quickly.”

“The soft economic backdrop, which still has downside, will drive inflation down over time … it’s just a question of how quickly.”

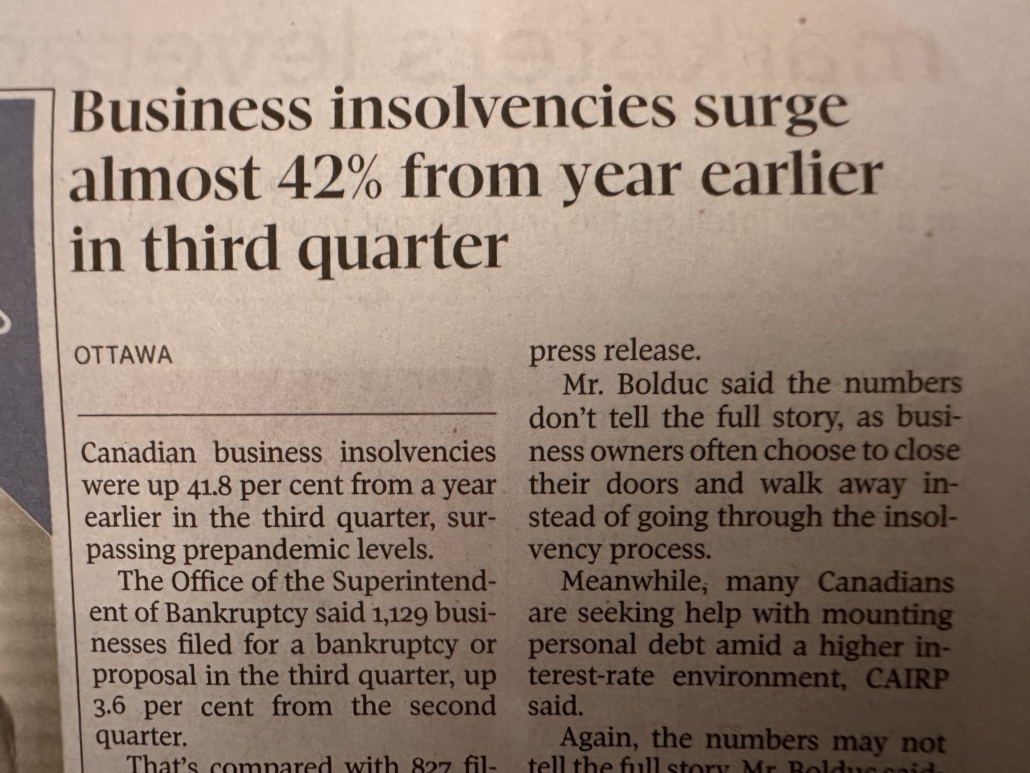

Here’s another news article from the Globe and Mail on Saturday that quietly screams what’s in store:

This huge rise in business insolvencies adds to all the other economic data that indicate our economy is headed for, or already in a recession. It is clear that businesses and households are suffering due to lower consumer demand, a deflating economy, and high interest rates.

All signs are pointing to the fact that the high rates are doing their intended damage to our economy.

With each news cycle, it seems that economists keep rolling back their timeframe for when the BoC will drop rates. Months ago, most economists were calling for prime rate to drop nearer to the end of 2024. Now, they’re predicting that rates will start to drop in spring of 2024. As more signs appear of an impending recession, that timeframe gets constantly pulled back.

In my best guess, the BoC will start to drop rates anywhere from December 2023 up to spring of 2024. If more damaging news rolls out, we might see some rate relief in time for Christmas. The latest the rates will start to drop is mid year, 2024, but I really do think it will be sooner than that. When we look at previous rate cycles, we can see that rates hover around their peak for 6 months to 9 months, which we are now approaching.

For all those people that keep saying rates are going to stay high for a long time, please stop the fear mongering. As I’ve stated in many of my previous blogs, monetary policy is CYCLICAL. Key word here: CYCLICAL.

Fixed Rate Thoughts.

Before the BoC makes any moves, there will be a flurry of more economic news that markets will react to. Any signs of recession or struggle in our economy, and money flows out of savings and bonds and back into business investment (ie, the stock market). Once money starts to flow out of savings and bonds, the yield on these investments will drop, and subsequently, fixed rates will start to drop too.

It’s not unreasonable for us to see significant drops in fixed rates before the BoC makes any moves on prime rate.

Last year around this time, we were selling fixed rate mortgages around the 4% mark. In February of last year, our 5 year rates were around 4.30%. In the late spring, rates were hovering around 4.85%. Over the summer, rates have skyrocketed to the highs we see now. Bond yields this week have dropped again, and we are starting to see sub-6% fixed rates again.

I do think that in the next 6 months to a year, we will be returning to rates that are in the 4.50%, perhaps even lower.

So What Is The Strategy On Mortgage Rates?

Economists agree – now is the time to go variable, as long as you can tolerate a small amount of risk. Take the variable rate for now, and wait until rates are hovering around 4.00% to 4.50%. That would be a much better time to lock in, in my humble opinion.

Again, I always have to say – variable rates are not for everyone. If you are the type of person to stay up awake in bed at night thinking about this, it’s a factor to consider. Your mental health is not worth sacrificing for a lower rate.

As always, if you’d like to discuss your mortgage or interest rates with me, my phone is open and I’m happy to help you with your decision.

Signing Off For Now,

David Steinberg, AMP, BComm

Lead Broker/Owner

Olympic Mortgage

2508587160

david@olympicmortgages.ca

There is no excerpt because this is a protected post.

There is no excerpt because this is a protected post.

Happy new year? Yeah, I know I’m crazy late here. I’m reminded of the Seinfeld episode where the characters debate when it’s officially too late to say “Happy New Year.” Jerry gets one in March. The gall. There should have been a newsletter out three weeks ago, honestly. I know I’m late on it. I’ve […]